Investing in property is a proven way to build wealth, offering opportunities for capital gains and a steady stream of rental income.

However, determining whether a property is a sound investment requires understanding key financial metrics—one of the most important being rental yield. This metric helps assess the cash flow return your investment property generates, ensuring you can make confident and informed decisions.

What is Rental Yield?

Rental yield represents the yearly revenue your investment property generates as a percentage of its value. It’s a vital indicator for assessing the income return on your investment.

The formula evaluates the relationship between the income generated (rental revenue) and the property’s cost, offering a straightforward way to determine whether a property is financially viable.

The higher the percentage, the better the rental yield, and by extension, the better the income-generating potential of your property.

Rental Yield

- Gross Rental Yield:

This measures the income return relative to the property’s purchase price before expenses. It’s a simple calculation used to quickly compare properties. - Net Rental Yield:

This considers all expenses associated with owning the property, such as maintenance, taxes, insurance, and property management fees. It provides a more accurate view of your property’s profitability.

What is Gross Rental Yield?

Investment properties create wealth through two main methods:

- Through capital gains, where the property value increases over time.

- Through rental income, which generates revenue for the owner.

Gross rental yield focuses on the second point. It measures the income return of your property relative to its purchase price, excluding expenses.

Why Gross Yield Matters:

Investors use gross rental yield as a comparison tool. If Property A has a higher gross yield than Property B, Property A generates more cash flow relative to its purchase price, making it a potentially better choice for income-focused investments, and more likely to be cash-flow neutral or positive.

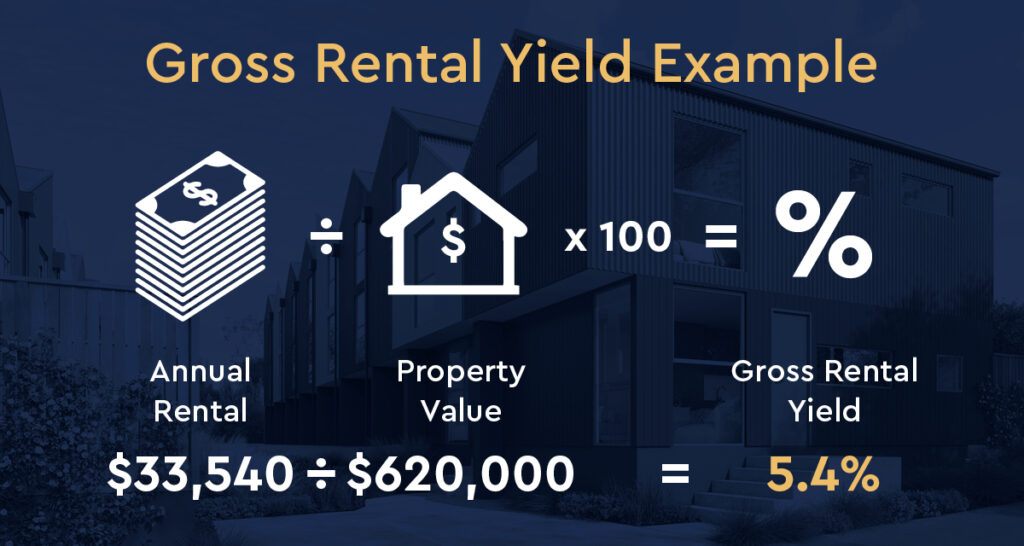

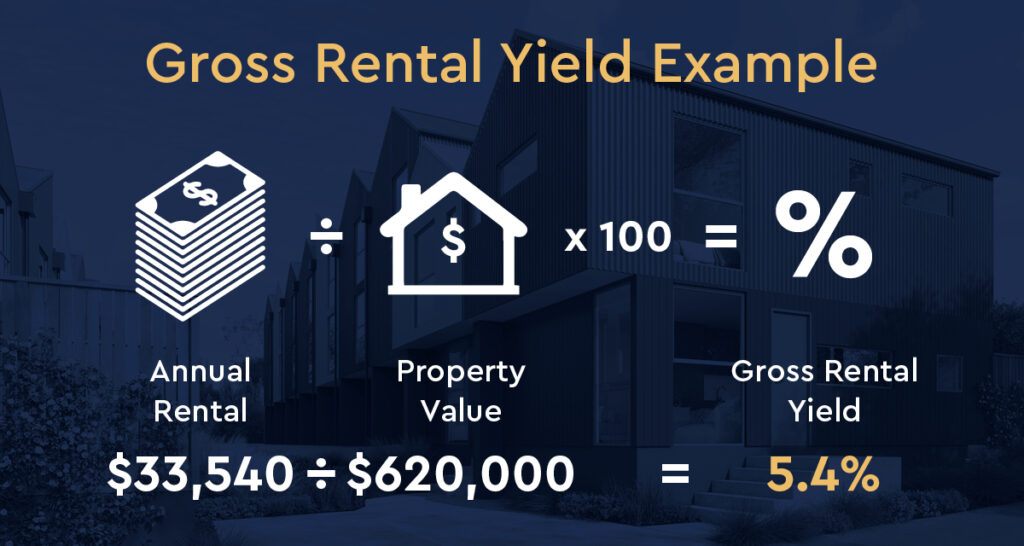

How to Calculate Gross Rental Yield

The formula for gross rental yield is straightforward. Follow these steps to calculate it:

- Calculate the Annual Rental Income

Multiply the weekly rent by the number of weeks in a year:

Annual Rental Income = Weekly Rent × 52

For example, if the weekly rent is $645:

Annual Rental Income = $645 × 52 = $33,540 - Divide the Annual Rental Income by the Purchase Price

Next, divide the annual rental income by the property’s purchase price.

For instance, if the purchase price is $620,000:

$33,540/$620,000 = 0.054 - Multiply by 100 to Convert to a Percentage

Finally, multiply the result by 100 to express it as a percentage:

Gross Rental Yield (%) =0.054 × 100 = 5.4%

Why Gross Yield is Only Part of the Picture

While gross yield is a valuable starting point, it doesn’t tell the whole story. Since it excludes expenses like maintenance, taxes, and insurance, it can paint an overly optimistic picture of your investment’s profitability.

To get a complete understanding, consider calculating net rental yield, which factors in these expenses to give a more accurate view of the net cash flow return on the investment.

Benefits of Using Rental Yield to Evaluate Properties

- Compare Properties Quickly:

Gross rental yield is a quick and easy way to compare the income potential of multiple properties. - Assess Cash Flow:

It provides insight into how much cash flow the property generates relative to its cost. - Make Informed Decisions:

By understanding a property’s yield, you can identify opportunities that align with your financial goals, whether that’s maximising rental income or balancing income with capital growth.

Calculating the return on an investment property is essential to making sound financial decisions. Gross rental yield is a powerful tool for evaluating the revenue potential of a property, while net rental yield provides a more detailed understanding of profitability.

Whether you’re a seasoned investor or new to the property market, understanding how to assess yield ensures you’re choosing properties that align with your financial goals.

At TGC Homes, we make property investment simpler and more secure.

As property investors ourselves, we understand that cash flow is key to successful property investment. That’s why we’re offering a 2-year rental guarantee for homes purchased from us, providing peace of mind by removing the uncertainty from your investment decision.

Take the uncertainty out of property investment - secure your future today with TGC Homes.